Decentralized Finance (DeFi) is reshaping the financial landscape. At the core of this transformation are crypto tokens. These tokens are more than just digital assets; they are driving innovation in how we handle, invest, and think about money. This blog will explore how DeFi platforms use crypto tokens to revolutionize finance and why this is a game-changer for the industry.

What is DeFi?

Decentralized Finance (DeFi) refers to a set of financial applications built on blockchain technology. Unlike traditional financial systems, DeFi operates without central intermediaries like banks. Instead, it relies on smart contracts and decentralized networks.

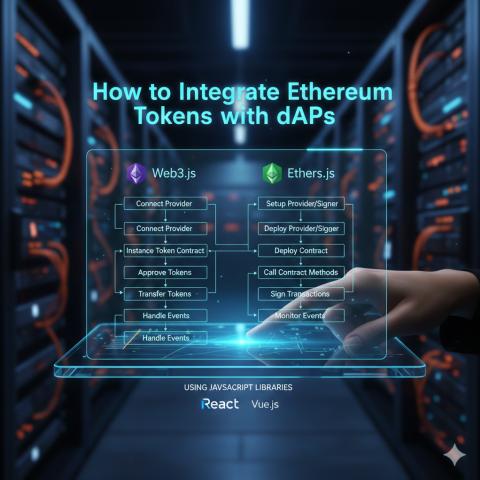

Smart contracts are self-executing agreements with the terms directly written into code. They run on blockchain networks, such as Ethereum. This setup eliminates the need for intermediaries and allows for more transparent, efficient, and accessible financial transactions.

The Role of Crypto Tokens in DeFi

Crypto tokens are fundamental to the DeFi ecosystem. They serve various purposes, including:

-

Utility Tokens: These tokens provide access to specific services within a DeFi platform. For instance, you might use them to pay transaction fees or participate in governance decisions.

-

Governance Tokens: These tokens give holders voting rights on protocol changes and upgrades. They play a crucial role in decentralized decision-making.

-

Stablecoins: These are tokens pegged to stable assets like the US dollar. They provide stability in a volatile market, making them essential for trading and lending activities.

-

Yield Farming Tokens: These tokens are earned by users who provide liquidity to DeFi platforms. They represent a share in the platform’s rewards.

How DeFi Platforms Use Crypto Tokens for Financial Innovation

DeFi platforms leverage crypto tokens in several innovative ways. Here’s how they are changing the financial world:

1. Creating Decentralized Exchanges (DEXs)

Decentralized Exchanges (DEXs) are a cornerstone of DeFi. Unlike traditional exchanges, DEXs operate without a central authority. Crypto tokens are used to facilitate trading on these platforms.

Users trade tokens directly with each other, often through an automated market maker (AMM) system. This system uses liquidity pools, where users deposit tokens to earn fees. The trading process is automated by smart contracts, making it fast and efficient.

2. Enhancing Lending and Borrowing

DeFi platforms use crypto tokens to facilitate lending and borrowing. Unlike traditional loans, these transactions are handled by smart contracts. Users can deposit their crypto tokens as collateral to borrow other tokens.

Lenders earn interest on their deposits, while borrowers can access liquidity without needing to go through a bank. This system is more accessible and often offers better rates than traditional financial institutions.

3. Enabling Yield Farming and Staking

Yield farming and staking are popular ways to earn returns on crypto assets. In yield farming, users provide liquidity to a DeFi platform and receive tokens in return. These tokens represent a share of the platform’s fees or rewards.

Staking involves locking up tokens to support the network’s operations, such as validating transactions. In return, users earn rewards. Both yield farming and staking are essential for incentivizing participation and liquidity in DeFi platforms.

4. Facilitating Cross-Chain Transactions

DeFi platforms often use tokens to enable cross-chain transactions. These transactions involve moving assets between different blockchain networks. Cross-chain solutions allow DeFi platforms to interact with multiple blockchains, increasing their flexibility and reach.

For example, a token on Ethereum might be wrapped and used on the Binance Smart Chain. This cross-chain functionality expands the use cases for tokens and enhances the overall DeFi ecosystem.

5. Tokenizing Real-World Assets

Tokenizing real-world assets involves creating digital tokens that represent physical assets like real estate, commodities, or art. DeFi platforms use these tokens to make traditional assets more accessible and tradable.

For instance, a real estate asset can be divided into several tokens, allowing multiple investors to own a fraction of the property. This process increases liquidity and democratizes access to investment opportunities.

The Impact of Crypto Token Development

Crypto token development is driving innovation in the DeFi space. By creating new types of tokens and improving existing ones, developers are enhancing the functionality and efficiency of DeFi platforms.

Here’s how crypto token development is shaping the future:

1. Increased Efficiency

Developing new crypto tokens allows DeFi platforms to improve efficiency. For example, new tokens can optimize transaction fees, enhance security, and reduce the time needed to execute trades. This increased efficiency benefits all users of the platform.

2. Enhanced Functionality

Crypto token development introduces new features and functionalities to DeFi platforms. Developers can create tokens with unique properties, such as enhanced privacy features or multi-chain compatibility. These innovations expand the range of services and use cases available to users.

3. Broader Adoption

As new tokens are developed, DeFi platforms become more versatile and appealing. This increased versatility can attract a broader audience, from casual investors to institutional players. As more people engage with DeFi platforms, the entire ecosystem grows and matures.

Choosing the Right Crypto Token Development Company

If you’re looking to develop crypto tokens for a DeFi platform or any other use case, choosing the right crypto token development company is crucial. Here’s what to consider:

-

Experience and Expertise: Look for a company with a proven track record in developing crypto tokens. They should have experience with various types of tokens and platforms.

-

Technology and Tools: Ensure the company uses advanced technology and tools for token development. This includes secure smart contract platforms and reliable blockchain networks.

-

Support and Maintenance: A good development company offers ongoing support and maintenance services. This ensures that your tokens and platform remain up-to-date and secure.

Conclusion

DeFi platforms are at the forefront of financial innovation, and crypto tokens are the driving force behind this transformation. From decentralized exchanges to cross-chain transactions, tokens are enabling new ways to manage and invest money.

Crypto token development is shaping the future of Supply Chain and Logistics, offering greater efficiency, functionality, and accessibility. By partnering with the right crypto token development company, you can leverage these advancements to create impactful and successful DeFi solutions.

As the DeFi ecosystem continues to evolve, the role of crypto tokens will only become more significant. Understanding how they work and the innovations they bring can help you navigate and succeed in this exciting space.