Stablecoins have long been heralded as the bridge between traditional finance and the crypto economy, offering price stability in a volatile market. What if stablecoins weren’t just stable but intelligent? AI agents are redefining how digital assets operate, enabling stablecoins to react, adapt, and optimize financial conditions without human intervention. Instead of relying on fixed reserves and manual adjustments, AI-powered stablecoins autonomously manage liquidity, predict market trends, and mitigate risks before they arise.

The question isn’t whether AI belongs in Stablecoin Development—it’s how businesses and investors can leverage this powerful synergy. Let’s dive into the mechanics of this financial evolution.

Understanding AI Agents in Stablecoin Development Ecosystems

AI is taking stablecoin development to the next level, transforming digital assets into intelligent, self-regulating financial tools. No longer just passive stores of value, stablecoins are now dynamic, adapting to market fluctuations and optimizing liquidity with AI-powered precision. So, how do AI agents fit into this? These autonomous systems work behind the scenes, continuously analyzing market trends, adjusting reserves, and ensuring algorithmic stability. In AI-powered stablecoin development, they act as financial watchdogs—predicting risks, preventing depegging, and optimizing transaction speeds for a frictionless user experience.

For investors and businesses, this is a game-changer. Stablecoin development solutions infused with AI mean fewer risks, greater efficiency, and smarter asset management. Imagine a stablecoin that can rebalance itself in real-time, block fraudulent transactions before they happen, and adapt to economic conditions without human intervention. This seamless fusion of AI and blockchain doesn’t just mitigate risks—it transforms stablecoins into self-sustaining financial entities. The result? A future where stability is not just maintained but intelligently enhanced.

AI-Agent Driven Stability: Reinventing the Core of Stablecoin Development

At the core of stablecoin development is maintaining unwavering price stability. While traditional stablecoins rely on fixed collateral or algorithmic adjustments, AI-powered stablecoin development mechanisms introduce greater precision, adaptability, and automation. AI agents enhance stablecoin resilience against market volatility, liquidity fluctuations, and external financial disruptions by leveraging real-time data analytics, predictive modeling, and self-executing stabilization strategies.

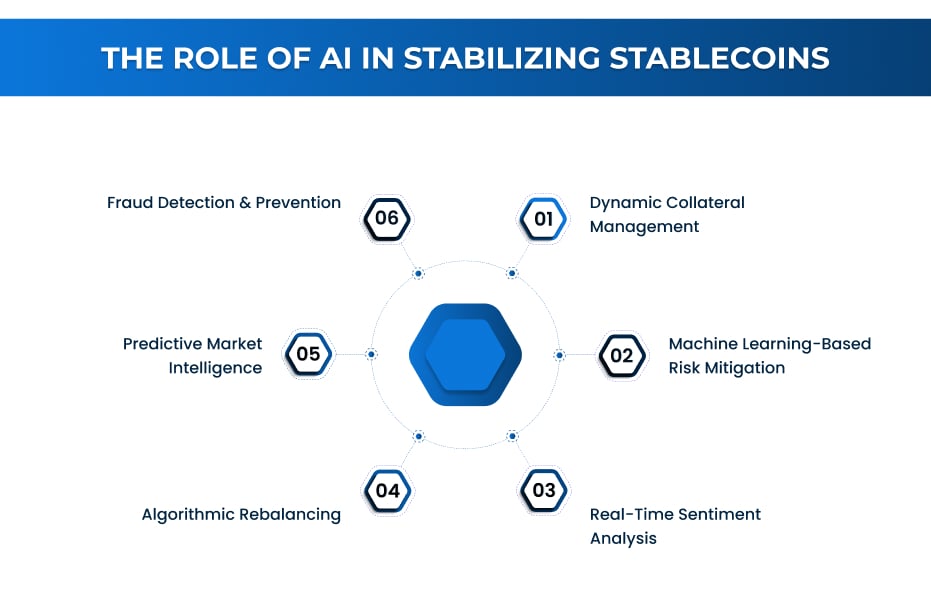

Dynamic Collateral Management – AI Agent ensures stablecoin reserves are always optimized to match market conditions.

- Automated risk assessment detects when collateral levels need rebalancing.

- AI-based smart contracts autonomously adjust collateral-to-debt ratios.

- Integration with DeFi protocols enables efficient collateral allocation.

Machine Learning-Based Risk Mitigation – AI continuously evaluates potential risks and applies preemptive solutions.

- Predictive models forecast price fluctuations and initiate stability measures.

- AI-driven hedging strategies automatically adjust asset exposure.

- AI scans historical data to identify and prevent potential de-pegging events.

Real-Time Sentiment Analysis – AI Agents capture market sentiment to anticipate trends and react instantly.

- NLP algorithms analyze social media, news, and financial reports in real-time.

- AI models detect sudden shifts in investor sentiment and adjust stablecoin supply accordingly.

- Automated alerts and response mechanisms prevent adverse market impacts.

Algorithmic Rebalancing – AI autonomously adjusts supply and demand to maintain stability.

- AI detects liquidity imbalances and executes corrective actions.

- Automated buy-back mechanisms prevent over-issuance or under-issuance.

- Smart treasury management optimizes asset holdings based on market needs.

Predictive Market Intelligence – AI Agents enhance decision-making for stablecoin governance.

- AI analyzes macroeconomic data to anticipate external market impacts.

- Smart algorithms track regulatory changes and suggest compliance adjustments.

- AI-driven simulations test various economic scenarios to enhance stability strategies.

Fraud Detection & Prevention – AI strengthens stablecoin security and trust.

- AI scans blockchain transactions for anomalies and suspicious activities.

- Real-time fraud detection prevents price manipulation and flash loan attacks.

- AI-powered identity verification ensures compliance with financial regulations.

AI isn’t just supporting stablecoin development solutions—it’s redefining them, introducing a new era of automation, precision, and market adaptability. But what does this mean in practice? Let’s break down the benefits of AI-driven stablecoins.

The Benefits of Stablecoin Development with AI-Agent Integration

AI-driven agents can execute payments, optimize financial operations, and facilitate decentralized transactions without human intervention by leveraging blockchain-backed stablecoin development solutions. Let’s dive into its compelling benefits and why it strengthens stablecoin development as a prime investment opportunity.

- Frictionless Transactions & Autonomous Payments: AI agents can send, receive, and settle payments instantly using stablecoins, eliminating delays and inefficiencies associated with traditional banking.

- Cost-Effective Micropayments & Machine-to-Machine Transactions: Stablecoins enable low-cost microtransactions, making pay-per-use services, data-sharing economies, and IoT-driven financial interactions more viable.

- Global Accessibility & Financial Inclusion: Stablecoins allow AI-powered financial services to operate borderlessly, reaching underbanked and emerging markets with real-time, decentralized payment solutions.

- Enhanced Security & Transparency: Blockchain-backed stablecoin development solutions ensure tamper-proof, fully auditable transactions, preventing fraud and enforcing regulatory compliance in AI-driven economies.

- Smart Financial Automation & Market Optimization: AI-driven agents can analyze market trends, dynamically adjust pricing, optimize asset allocation, and execute financial strategies in real time.

- Seamless AI-to-AI Transactions: AI agents can negotiate and transact autonomously, facilitating machine-to-machine commerce, decentralized data exchanges, and automated service agreements.

- Stable Value Exchange in AI-Driven Economies: Unlike volatile cryptocurrencies, stablecoins provide a consistent and reliable medium of exchange for AI-driven digital economies and services.

- Programmable Payments with Smart Contracts: AI-powered smart contracts enable self-executing agreements, automating lending, insurance payouts, and revenue-sharing models with zero manual intervention.

- Decentralized AI Monetization: Developers can tokenize AI models and services, allowing AI agents to monetize data, computing power, and digital services through stablecoin-based payments.

- Scalability & Interoperability: Stablecoins can seamlessly integrate with DeFi protocols, NFT marketplaces, and decentralized platforms, expanding AI agents’ capabilities across multiple ecosystems.

Stablecoins will act as the backbone of an autonomous, decentralized financial system, enabling businesses and investors to capitalize on the growing AI-driven economy. The synergy between stablecoins and AI agents is unlocking unprecedented financial automation. But to harness its full potential, businesses must approach stablecoin development with precision. Here’s a comprehensive guide to building an AI-powered stablecoin.

How to Build AI-Integrated Stablecoin Development Solutions ?

Developing an AI-powered stablecoin requires a meticulous approach, merging stablecoin development solutions with cutting-edge AI capabilities. Here’s how businesses and investors can strategically navigate the process.

- Define Stability Model & AI Integration: Choosing between collateralized, algorithmic, or hybrid models is the foundation. AI-driven mechanisms must be embedded to ensure dynamic stability adjustments.

- Implement AI-Powered Risk Assessment: AI models should be trained on financial data to predict volatility, adjust collateral reserves, and optimize liquidity management in real-time.

- Design Smart Contracts with Adaptive Logic: Integrate AI-enhanced smart contracts to autonomously trigger stabilizing actions, including supply adjustments, buybacks, and algorithmic rebalancing.

- Develop AI-Driven Market Intelligence Systems: Incorporate machine learning algorithms to analyze macroeconomic trends, investor sentiment, and market fluctuations, allowing stablecoins to self-correct.

- Ensure Regulatory Compliance & Security: AI-powered compliance frameworks should be integrated to monitor transactions, detect fraud, and adapt to evolving regulatory requirements.

- Optimize Treasury & Liquidity Management: AI should automate treasury operations, dynamically allocate reserves, and execute hedging strategies for sustainable asset backing.

- Enable AI-to-AI Transaction Networks: Stablecoins must support autonomous AI transactions, enabling seamless, trustless value exchange across decentralized ecosystems.

A well-structured stablecoin development strategy ensures resilience, efficiency, and long-term sustainability, making it an attractive frontier for investors and businesses. Partnering with a stablecoin development company unlocks the full potential of AI-driven financial automation.

Timing is everything in financial innovation. So, how long does it take to develop an AI-integrated stablecoin? Let’s walk through the development timeline and what to expect at each stage.

How Expensive and Time-Intensive Is AI-Powered Stablecoin Development?

AI-powered stablecoin development is a technically intricate process that merges blockchain stability with AI-driven intelligence. Unlike traditional development, AI integration demands advanced machine learning models, predictive analytics, and autonomous liquidity management to ensure real-time market adaptability. Implementing self-executing smart contracts, algorithmic rebalancing, and AI-driven risk assessment enhances stability but requires a sophisticated development approach. An expert stablecoin development company ensures seamless AI integration, regulatory compliance, and scalable development solutions. For investors and enterprises, this innovation unlocks a new era of intelligent, self-sustaining financial ecosystems, redefining efficiency, security, and adaptability in digital finance.

AI-Agent + Stablecoins: The Smart Move for Visionary Investors

Traditional stablecoin models are rapidly becoming obsolete. AI-integrated stablecoins leverage reinforcement learning, neural networks, and algorithmic rebalancing to maintain market stability with zero human intervention.

Ready to build a next-gen, AI-powered stablecoin that sets the benchmark for the industry? Choose Antier, an expert stablecoin development company, to seamlessly integrate AI-driven stability, predictive intelligence, and automated financial ecosystems into your digital asset framework. We offer comprehensive stablecoin development services, including AI-powered smart contract development, algorithmic collateral management, real-time risk assessment, and DeFi integrations to ensure seamless automation and long-term financial resilience.

The future of DeFi is already unfolding—stay ahead of the innovation curve and lead the way in AI-enhanced financial solutions.