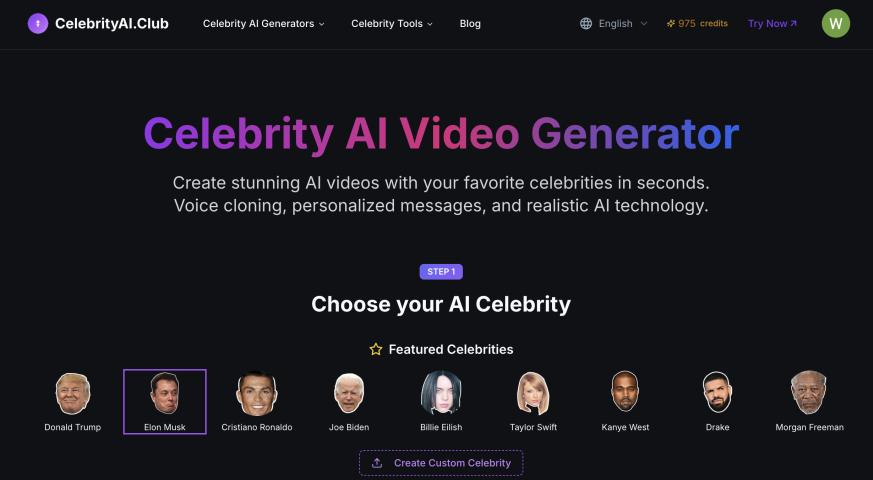

Introduction

Choosing the proper legal structure for your business is crucial when setting up a venture in Saudi Arabia. With various business entities available, it's essential to understand the implications of each structure, particularly in terms of registration, taxation, ownership, and liability. This article provides an overview of business formation options in Saudi Arabia, helping entrepreneurs navigate the complexities of selecting the best structure for their company.

Understanding Business Entity Options in Saudi Arabia

When you register your company in Saudi Arabia, several business structures must be considered. Each has unique requirements, benefits, and limitations.

1. Sole Establishment

A sole establishment is the simplest business structure commonly used by small business owners. In this model, the business and owner are legally the same entity, meaning the owner has complete control but also assumes all liabilities. It's a straightforward way to start a company, but the owner's assets are at risk in the event of any legal or financial issues.

Key Considerations

Simple and quick registration process.

The owner bears unlimited liability.

Suitable for small businesses and local entrepreneurs.

2. Limited Liability Company (LLC)

The most popular choice for foreign investors is the Limited Liability Company (LLC), where the company's liability is limited to the shareholders' capital. This structure offers flexibility and protection, as the business's debts and obligations don't extend to the personal assets of its owners. An LLC in Saudi Arabia requires a minimum of two shareholders and a local partner who holds at least 25% ownership in some cases.

Key Considerations

Limited liability for shareholders.

Requires at least two shareholders.

Can engage in a wide range of business activities.

In some industries, a Saudi national must hold some ownership.

3. Joint Stock Company (JSC)

A Joint Stock Company is ideal for larger ventures that require significant capital investment. This structure allows a company to issue shares to the public, making it suitable for businesses that aim to list on the Saudi stock exchange. The JSC requires a minimum of five shareholders and a larger initial capital outlay.

Key Considerations

Suitable for large-scale businesses.

Allows for the public trading of shares.

Requires a significant capital investment.

4. Branch of a Foreign Company

International companies looking to operate directly in Saudi Arabia can establish a branch office. This structure allows the foreign entity to engage in the same business activities as in its home country but is subject to Saudi laws and regulations. The branch remains part of the foreign parent company, meaning all profits and liabilities ultimately belong to the overseas entity.

Key Considerations

Directly linked to the parent company.

Requires approval from the Ministry of Investment for Saudi Arabia (MISA).

Ideal for companies looking to maintain full foreign ownership.

5. Joint Venture

A joint venture is a contractual agreement between two or more parties to collaborate on a specific project. While it doesn't require the creation of a new legal entity, joint ventures can benefit companies looking to pool resources and expertise. Typically, joint ventures in Saudi Arabia involve a partnership between a foreign company and a Saudi entity.

Key Considerations

Flexible partnership model.

No need to create a new legal entity.

Common in large, project-based industries.

Factors to Consider When Choosing a Legal Structure

Ownership Restrictions: Foreign investors may need a local partner for certain business activities. However, full foreign ownership is permitted in specific industries, particularly with MISA approval.

Liability: LLCs and JSCs limit liability to the amount of capital invested, while sole establishments place full liability on the owner.

Capital Requirements: Some structures, like JSCs, require significant upfront investment, while others, like sole establishments, have minimal capital requirements.

Taxation: Each structure has different tax implications, particularly concerning profits and ownership shares.

Conclusion

Choosing the proper business structure is a critical decision that can shape the future of your venture in Saudi Arabia. Whether you're looking for simplicity, full foreign ownership, or limited liability, the options are varied. Sole proprietorships are ideal for small, local businesses, while LLCs and JSCs are more suitable for foreign investors and large-scale ventures.

You can rely on the Saudi Helpline Group for expert assistance in navigating the complexities of business formation in Saudi Arabia. Their expertise in registration and legal structures can help ensure a smooth setup process for your company, allowing you to focus on growing your business with confidence.