In my previous articles, I posted a beginner's guide to using HFM and steps to set up your HFM account. In my article today, I will share tips on how to make a profitable trading on HFM. Below are the 6 main steps. I have compiled 12 of them but will be sharing 6 tips now and the rest in my next post, to make this post short and easy to read. So be on the lookout for the next post.

1. Start with a Demo Account

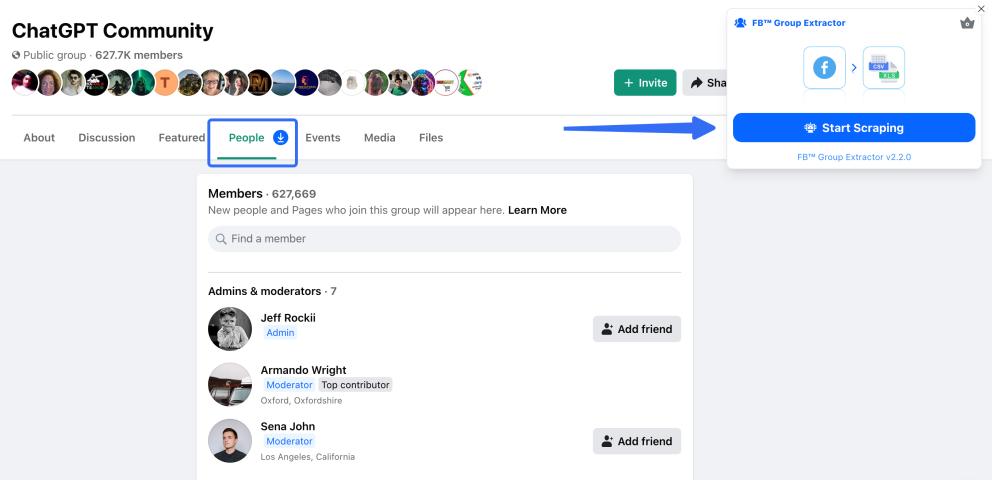

HFM offers a free demo account that allows you practice trading without risking real money. This is an excellent way to get comfortable with the platform and test your strategies in real market conditions. Spend time to learn with the demo account to understand how the market moves and refine your trading approach. Use this link to create an account

2. Educate Yourself

Take advantage of the free educational materials provided by HFM. Learning about on their platform, forex fundamentals, risk management, and technical analysis can greatly improve your chances of success. Participate in webinars, read eBooks, and watch tutorials to stay informed about market trends, trading strategies, and platform features.

3. Manage Risk Wisely

One of the most important lessons for new traders is to manage risk. Use stop-loss orders to limit potential losses and never risk more than you can afford to lose on any trade. Aim to use a risk-reward ratio of at least 1:2, meaning your potential profit should be at least double the amount you’re willing to risk.

4. Use Leverage Cautiously

While leverage can amplify potential profits, it also increases your exposure to risk. Beginners should start with lower leverage and only increase it as they become more experienced. Always keep in mind that leverage can quickly magnify losses just as much as it can magnify gains.

5. Stay Updated with Market News

The forex market is influenced by global events, so staying updated with financial news is essential. HFM provides regular market updates and news feeds directly on the platform. Following economic indicators like interest rates, inflation data, and political news can help you anticipate market movements and adjust your strategy accordingly.

6. Create a Trading Plan

A trading plan helps you stay disciplined and focused on your long-term goals. Outline your strategies, including entry and exit points, risk management rules, and profit targets. Stick to your plan, and avoid emotional trading, as it can lead to impulsive decisions and unnecessary risks.

To learn more about HFM use the link and follow our social media handle using this link.