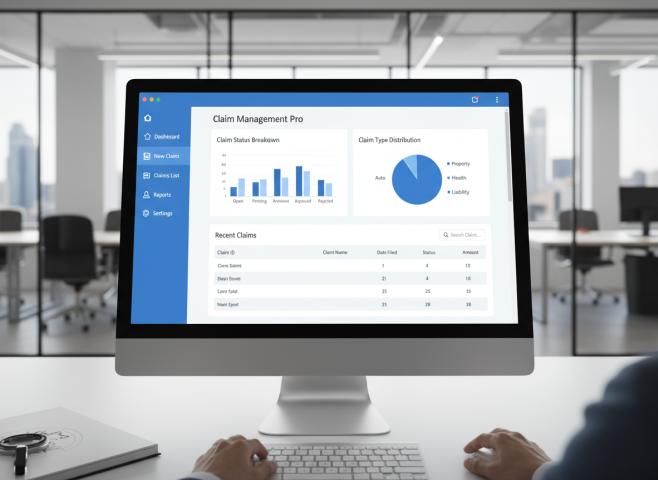

For the smooth and fast process of insurance claiming data must be digitized. A lapse in insurance data delay may lead to financial setbacks for any company. Data Entry Expert provides electronic formats that are easily readable and accessible and eliminate any delay issues so the insurance processes your claim faster. Entering such data into a database can be a tedious job, so hiring an outsourcing insurance data entry service company is the one-stop solution for a business.

Outsource Insurance Claim Data Entry Services

Written by

dataentryexpert

504 days ago

Related articles:

Insurance and Mutual Funds: A Complete Guide for Smart Financial Planning

Insurance plays a vital role in financial protection by safeguarding individuals and families from unexpected events such as medical emergencies, accidents, disability, or the loss of an earning member. Life,..

Business Insurance: A Strategic Asset for Long-Term Growth

Corporate leaders often focus their attention on revenue growth, innovation, and operational efficiency, but one of the most underestimated pillars of sustainable success is insurance. Far from being a mere..

Why Startups Can’t Afford to Ignore Insurance

Launching a startup means navigating uncertainty, tight budgets, and constant pressure to grow. Amid the hustle of product development, hiring, and fundraising, insurance is often overlooked—until it's too late.Risk Is..

Property and Casualty Insurance: Top Challenges and Key Trends Shaping the Industry

The property and casualty insurance industry is evolving rapidly amid growing risks, regulatory complexity, and rising customer expectations. This blog highlights the top challenges insurers face and explores key trends..

Top 10 Tips to Renew Car Insurance Smartly

IntroductionCar insurance renewal is often treated as a routine task, but failing to renew car insurance with proper evaluation can lead to higher premiums, inadequate coverage, or missed benefits. With..

10 Things You Must Know About Renewing Your Car Insurance

Renewing your car insurance is not just a routine task—it is a crucial decision that directly affects your financial security, legal compliance, and peace of mind on the road. When..

Car Insurance Policy Online in India: Step-by-Step Buying Guide

IntroductionIn today’s digital era, buying a car insurance policy

online has become the preferred choice for millions of Indian

vehicle owners. Opting for a car insurance policy online offers unmatched..

Improve Policy Personalization Effectiveness with Insurance CRM Software

Risk assessment tools enable brokers to match specific client needs with appropriate coverage options. CRM for life insurance agents excels at tracking individual health profiles and life changes that affect..

What Is Digit Third-Party Car Insurance? Coverage, Benefits & Legal Requirements Explained (2025)

What Is Digit Third-Party

Car Insurance and What It Covers?Owning a car is not just

about convenience and mobility; it comes with responsibilities that safeguard

both the vehicle owner and..

How to Contact ICICI Lombard Car Insurance Customer Care? (Complete Guide 2025)

When

it comes to car insurance, timely customer support can make a big

difference—especially during an emergency, breakdown, accident, or claim

situation. ICICI Lombard Car Insurance Customer Care

ensures that..

Speed up Insurance Payouts with Automated Claims Processing Solutions

Automation makes every claim processing step more efficient from the first notice of loss to final payment. The automated claims processing insurance solutions handle routine cases without human intervention. This..

Driving Insurance Excellence with Automated Claims Processing Solutions

The right claims automation solution delivers advantages that extend beyond basic efficiency improvements. Fraud detection capabilities in automated claims processing solutions improve significantly when advanced algorithms analyze claim patterns. Staff..

Boost Claims Automation Effectiveness with Strategic Implementation

Insurance companies should approach claims automation as a strategic investment rather than just a technology upgrade. Those who assess their specific requirements before insurance claims processing automation solution implementation achieve..

Transforming Payer Experience with AI-Powered Healthcare Claims Management

Revolutionize payer operations with AI-powered healthcare claims management software that enhances claims accuracy, minimizes denials, and accelerates settlements — delivering a seamless experience for payers while reducing administrative burdens.Streamline claims..

Expand Insurance Services Footprint with Claims Processing Automation Solutions

The future of global insurance depends on how effectively companies can navigate regulatory differences across borders. Claims processing automation represents a strategic necessity for insurers with international ambitions. Companies that..

Drive Claims Processing System Modernization with AI Agent Integration

Several insurance firms continue to manage legacy insurance claims processing software in their digital infrastructure. Such insurers can modernize these systems by enabling integrations with AI agents. These agents can..

Eliminate Manual Risk Evaluation with Claims Automation Software

Multimodal decision support systems offer insurance companies a practical solution to overcome traditional claims processing limitations. By integrating these systems in claims automation software, insurers can address the core issues..

Overcoming Key Challenges in Insurance Claims Management

This article from Insurance Thought Leadership explores the most pressing challenges facing insurance claims operations today, including process inefficiencies, fraud detection, customer dissatisfaction, and legacy system limitations. It offers practical..